Sometimes getting there is half the fun

Our goal is to autograph everything we do with excellence!

Retirement Income Planning

Do you know where your income is going to come from after you stop working?

There's a lot more to this than how your portfolio is doing! Have you planned today to pay less in taxes after retirement? How will Social Security fit? Can it be maximized? Health insurance? What if I need nursing home care?

A good financial plan will address all of these things, and more.

We can help you put this plan in place, and on paper, such that you'll be able to see at a glance how you're progressing.

Are you confident that your company plan is doing as well as it should? We'll help with that too.

Retirement should be an exciting time in life! We'd like to help you make that happen.

Why Invest With Us?

It's about what you keep

From the beginning or 2022 until the end of September the S&P 500 experienced a decline of almost 25%

If you retired that January with a million dollar portfolio you’re now looking at $750K. And don't forget the taxes.

How do you feel about that? In 2008 the market for many investors experienced more than a 50% drawdown that took almost six years to recover. That kind of news can be devastating to a retiree investor.

But what if there were a better way? As an independent investment advisor I am free to research different fund managers around the country and choose those firms who have delivered consistent gains over time. “Well, any investment firm can do that, Larry!” you might say. That’s true. But how have those firms done when things got ugly? Do they just stand back and say, “just hold on....it will come back?” I wanted to find managers who outperformed during the downturns.

I'm happy to be affiliated with a firm located in Nashville, Tennessee called Virtue Capital Management. What VCM has done is noteworthy. Through VCM, we can offer our investment clients:

A full spectrum of investment options.

Tactical and strategic risk management for today’s volatile markets.

Active management rather than passive.

The hallmark of VCM is the use of stop-loss portfolio’s and something called the VCM Overlay. During periods of high volatility our managers have the ability to move assets to safety, thereby preserving that money to buy back in at a discount as the market recovers.

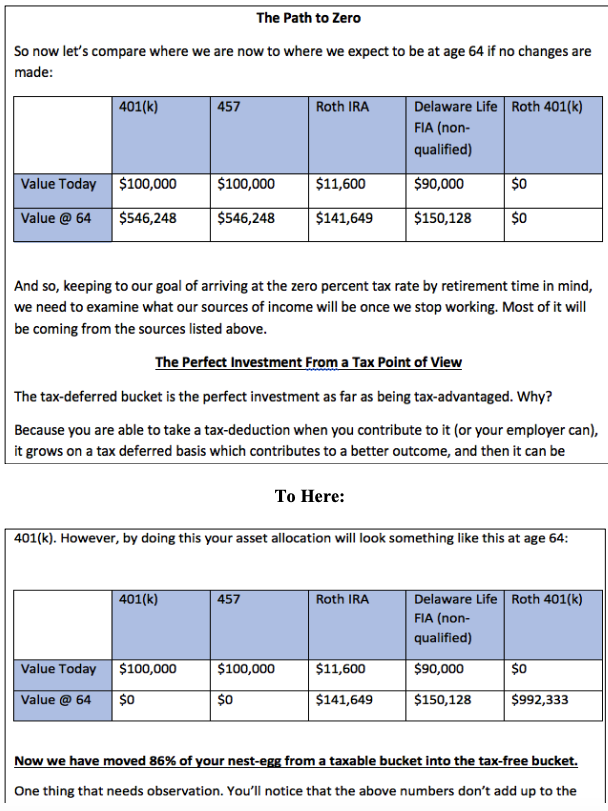

Taxes

The Number One Retiree Issue!

From rising tax rates to insidious IRMAA Medicare charges, Americans seem to be working more and more just to keep up with their tax bills.

A huge part of what we do is designed to help you avoid (legally, of course) taxes down the road. All of our planning is done with an eye on making our clients happier on April 15th.

Whether it's advanced estate planning, IRMAA avoidance strategies, or the use of life insurance, trusts and Roth conversions, there's a lot you can do.

We'd like to help you!

Personal Coaching With Your Company Plan

Need some help with that 401(k)? Now you can have an advisor with some skin on

Remember that glorious day when you were hired in your dream job? Oh, glory....

Perhaps the highlight of that day was when you were told that you were now entitled to a company-sponsored tax-deferred retirement plan. And your boss is going to contribute to it as well! Free money!

There’s only one problem. You’re not exactly Warren Buffett. Are the investment choices you were given any good? Is there some decision that you need to make on occasion? Who do you go to for advice?

Welcome to the Self-Directed Brokerage Account

Recent legislative changes have compelled many companies to offer the option of bringing their own personal financial advisor alongside to help them manage their company plan. We’re happy to be able to provide that service here at NavStar.

Even in the face of an increasing number of robo-advisors and do-it-yourselfers, there is an abundance of recent studies that emphasize the importance of client-advisor relationships. These reports prove that advisors can add 3% to clients’ net returns and retirement savers who sought investing advice enjoyed a median annual return almost 3% higher than those who didn’t – even after the fees they paid for that advice.

Now you can enjoy the benefits of having a professional planner and investment advisor alongside you as you navigate the company-sponsored plan, and without sacrificing the company match. Don’t leave your 401(k) and your future financial picture to chance.

College!

Pay for College Without Wrecking Your Retirement

You’ve done well. You’ve swung for the fences and made all the right moves. Your 401(k) is on track. You’re making great progress on your mortgage. Your family and friends are still talking to you, and you are expecting to retire with enough money to buy the Queen Mary! Life is good.

But then the magic day arrives when Junior enters High School. One night your eyes swing open at 3 AM. It’s time to start looking at college!!

What you learn next is frightening....Duke University is $80K a year. Even state schools such as UNC Chapel Hill or NC State are approaching $30K. That’s anywhere from $120 to $320 thousand to put Junior through school. All of a sudden that 401(k) doesn’t seem in such good shape.

How can you get through all this without wrecking your retirement?

At NavStar, we know the strategies that will help protect your retirement assets. It’s a unique partnership: eCollegePro manages the student and college relationship in order to make your student as attractive as possible to the school. We’ll handle the financial side in order to spend as little of your money as possible by maximizing scholarships and free money. Colleges are a business. Saving your family money on college is OUR business.

A Boutique Firm For Boutique Clients

Experience NavStar!

704 663 7482 schedule a free assessment

219 Williamson Rd. Suite 2202

Mooresville, NC 28117

704 663 7482

1 Timothy 1:17

Investment advisory services offered through Virtue Capital Management, LLC (VCM), a registered investment advisor. VCM and NavStar Financial Services are independent of each other. Consulting, insurance, and education services offered through NavStar Financial Planning.

The content of this website is provided for informational purposes only and is not a solicitation or recommendation of any investment strategy. Investments and/or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives. Information provided is not intended as tax or legal advice and should not be relied on as such. You are encouraged to seek tax or legal advice from an independent professional. Larry Jones and/or NavStar Financial Services are not affiliated with or endorsed by the Social Security Administration or any other government agency.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.